Tax Advantaged Income & Municipal Bonds - Brookfield, Wisconsin

Click here to signup to receive our regularly updated "Tax-Advantaged Investments List".

Tax-advantaged income can be difficult to find, but municipal bonds are one of the most common sources.

Municipal bonds pay interest that is free from federal income tax (in Wisconsin municipal bonds may be free from state taxes as well) and are issued by local and state municipalities. The tax-free nature of their income often makes municipal bonds attractive for investors in a higher tax bracket. You must account for the tax benefits of municipal bonds when comparing them to corporate bonds.

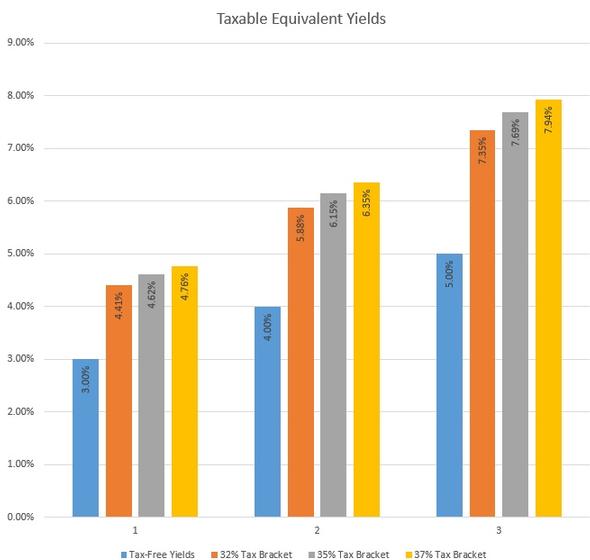

Tax equivalent yields are based on combined federal and state tax rates of 32%, 35%, and 37%.

For example; if your income puts you in the 35% tax bracket then a 4% municipal bond has a tax equivalent yield of 6.15%. That means you'd have to find a corporate bond paying better than 6.15% to compete with a 4% municipal bond.

Please be advised that income from municipal securities is generally free from federal taxes and state taxes for residents of the issuing state. While the interest income is tax-free, capital gains, if any, will be subject to taxes. Income for some investors may be subject to the federal Alternative Minimum Tax (AMT).

Investments in fixed-income securities are subject to market, interest rate, credit, and other risks. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in a decline in the bond's price. Credit risk is the risk that an issuer will default on payments of interest and/or principal. This risk is heightened in lower-rated bonds. If sold prior to maturity, fixed-income securities are subject to market risk. All fixed-income investments may be worth less than their original cost upon redemption or maturity.

Click here to signup to receive our regularly updated "Tax-Advantaged Investments List".

Municipal bonds can be complicated. There are general obligation bonds, revenue bonds, pre-refunded bonds, bonds with sinking funds, insured bonds, Build America bonds, unrated bonds, and bonds subject to AMT. BKM Wealth Management is a family team of financial advisors in Brookfield, Wisconsin. We're here to help you navigate the complexity and create income for you in retirement. Please contact us to discuss your situation.

The content on this page has been provided for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Since each person's situation is different you should review your specific investment objectives, risk tolerance and liquidity needs with your financial, tax and legal professionals before selecting a suitable savings or investment strategy.

BKM Wealth Management does not offer tax or legal advice.